Portfolio optimization: Difference between revisions

Jump to navigation

Jump to search

Kevinpan156 (talk | contribs) No edit summary |

Kevinpan156 (talk | contribs) |

||

| Line 5: | Line 5: | ||

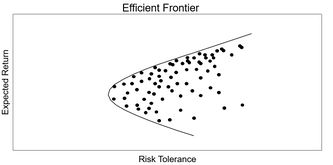

Risk is a major factor in choosing stocks in a portfolio. In order to mitigate these risks, investors typically use an efficient frontier graph as shown in figure 1. | Risk is a major factor in choosing stocks in a portfolio. In order to mitigate these risks, investors typically use an efficient frontier graph as shown in figure 1. | ||

[[File:Figure 1- Efficient Frontier Graph.jpg|thumb|333x333px|Figure 1: Efficient Frontier Graph]] | |||

== Theory == | |||

Revision as of 21:17, 28 November 2021

Authors: Ainsely Li (fl366), Kevin Pan (kp428), Qizeng Sun (qs95), Hanshen Li (hl2436), Eric Luo (yl2429) Fall 2021

Introduction

Portfolio optimization is a way to minimize risks to maximize net gains in a portfolio. Apply probability statistics, linear algebra, optimization and other methods to redistribute the investment portfolio under the established target returns and risk limits to achieve the goal of reducing risks or obtaining higher benefits under the same risk conditions.

Risk is a major factor in choosing stocks in a portfolio. In order to mitigate these risks, investors typically use an efficient frontier graph as shown in figure 1.